Saleh Kamil Islamic Banking Study and Research Center

Introduction

___________________________________________________________________________________________________

The report presents a preliminary vision for establishing Salih Kamil Islamic Banking Center and some elements of the Action Plan for the first three years of the. The report also addresses the initial organizational structure for the initial phase of the implementation of the master plan, and detailed legal and regulatory infrastructure, in addition to human resources, material and budgetary requirements for the for the first three years.

___________________________________________________________________________________________________

Center's mission is to actively contribute to the development of science, and the dissemination of knowledge and awareness of Islamic banking. Promotes professional excellence and scientific rigor and quality in the field of Islamic banking and by working with all who shared this vision and aspiration for the development of Islamic banking.

To be the leader at the local, regional and global levels in the area of research and development and to raise awareness in the field of science and knowledge on Islamic banking.

Mission will be achieved through the implementation of the following objectives:

- Review and evaluation of financial products and innovations in the field of Islamic banking & finance.

- Development and marketing of Islamic banking and financial products and innovations.

- Develop, support and sponsor studies and qualitative research in the field of Islamic banking, leading to results that will contribute to policy formulation and decision-making by the appropriate public and private institutions.

- Publish and disseminate research and studies in Islamic banking through academic publications and media, conferences and periodic seminars and activities held by the Centre to disseminate the culture and philosophy of Islamic banking and the potential benefits to communities, and follow up the practical application of research results.

- Capacity building in research, development and training on Islamic banking.

- Support knowledge networking among graduate students in the disciplines of law, economy, banking, insurance, and the Centre to achieve a degree of legal integration in the perception of the concept of Islamic banking and Islamic economics.

- Provide support and technical advice to university faculty members and students specialized in Islamic economics and Islamic banking through their Salih Kamil Center membership so that the Center will be an integral part of the university's academic activity.

- Development and support of comparative studies in Islamic banking and conventional banking.

- Support and guide research aimed at creating Islamic financing products.

- Establish statistical information and database center in the field of Islamic banking and the related studies and research.

- Conduct conferences, seminars and specialized courses and workshops in the field of Islamic banking.

- Publish professional newsletter and a magazine(s) to highlight Islamic banking studies and researches.

- Establish a specialized library in Islamic banking researches and studies. Provide reference books to help students and researchers in this field.

- Seek to develop curricula in the field of Islamic banking.

- Undertake any other activities that would contribute to the development of the Islamic banking sector.

Tasks and activities

___________________________________________________________________________________________________

- The Center will enrich and develop the knowledge and science of Islamic Finance. It will examine the challenges and obstacles and opportunities and recommend solutions. It will further provide services to the banking industry in the Kingdom and beyond.

- The Center combines and blends management experience and highly qualified academic specialists in the field of conventional and Islamic banking, and provides the framework where knowledge, research and education of Islamic banking development will come together.

- The Centre will serve as a consulting firm in issues relating to Islamic banking through the implementation of the following tasks:

- Research Tasks:

- Conduct researches at the local, regional and international levels.

- Collect, analyze and disseminate information Islamic banking information.

- Study, attract and develop financial innovations and new technologies appropriate for the Islamic banking sector.

- Promote mutual research ties with other institutions.

- Support and fund Islamic banking research and development projects.

- Publish a dedicated Islamic banking research journal.

- Advisory functions:

- Building a database of Islamic banking and finance.

- Set up standards and specifications of Islamic banking products and innovations.

- Education and Training Functions:

- Provide custom training courses for interested Islamic banking personnel.

- Cooperate with educational and training institutions in the development of Islamic banking curriculum and plans.

- Awareness, Marketing, and Media Functions:

- Publish periodical newsletters on Islamic banking and finance.

- Raise the awareness of the importance of Islamic banking locally and regionally.

- Others:

- Conduct periodical academic conferences on Islamic banking.

- Conduct periodical seminars in the field of Islamic banking.

- Conduct workshops in the field of Islamic banking.

- Research Tasks:

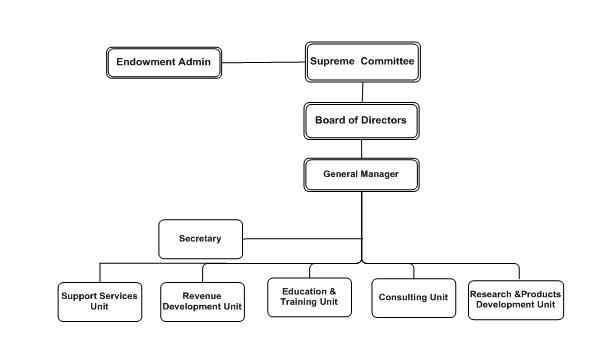

Organizational structure

___________________________________________________________________________________________________

- Supreme Committee

- Management of the Endowment

- Board of Directors

- Director-General

- Secretariat

- The Research and Product Development Unit

- The consulting unit

- The Education and Training Unit

- Revenue Development Unit

- Support Services Unit

- Listen

- Read phonetically

- Dictionary

Proposed Organization Structure

___________________________________________________________________________________________________

(The First Three Years)

Tasks to be Completed During the Foundation Phase:

The Foundation Phase (First Year)

The following core functions require an agreement with Dallah Al Baraka Holding Company during the first year of the foundation phase:

- Agreement on the bylaws and organizational structure of Salih Kamil Islamic Banking Study and Research Center.

- Nominate members of the Supreme Committee.

- Nominate members of the Board of Directors.

- Appoint the Director General.

- Agree on the action plan of the first three years, and business plans of each year.

- Allocation of budgets for each year of the first three years.

- Propose drafts of bylaws, policy and procedure.

- Develop an Internet website.

- Inauguration will take place by mid of first year, followed by implementation of the first year’s action plan.

- Allocate financial endowment to the Center.

- Select, furnish and prepare the Center’s premises.

- Recruitment of the preliminary phase personnel (managers of major units, administrative and support personnel).

- Conduct a seminar to shape the future of the Center.

- Completion of Strategy:

- Vision and tasks (long term)

- Executive plans (three years).

- The final organizational structure.

- Set up a marketing plan.

- Develop a database.

- Establish a library.

- Conduct end of year audit and make necessary adjustments. setup the operational plans for the second and third years.

Second Year

- Publish the first issue of the Center’s Journal (half-yearly / professional / bilingual / independent or belonging to King Saud University Journal / approved by the Scientific Council for purposes of promotion).

- Publish periodical publications of the Center (periodical newsletter and a quarterly journal focused on issues of Islamic banking).

- Seek contributions of outstanding researchers and scholars on the first issue of the Journal to lay the scientific level of the Center.

- Conduct the first annual meeting.

- Conduct the first scientific conference which will focus on a specific issue of Islamic banking (selective conference papers may be published in the first issue of the Journal).

- Conduct first training course.

- Convene periodical seminars and symposia.

- Launch the first postgraduate Diploma of Islamic banking.

Third year

- Release the second issue of the Journal.

- Publish a booklet of the first scientific conference.

- The Second annual meeting.

- Provide more training courses.

- Organize periodical seminars and symposia.

- Launch a Master program in Islamic Banking.

___________________________________________________________________________________________________

Universities

- King Saud University.

- King Abdulaziz University.

- University of Imam Muhammad bin Saud.

- Umm Al Qura University.

- University of Medina

___________________________________________________________________________________________________

- Ministry of Finance.

- The General Presidency of Scholarly Research and Ifta.

- Ministry of Economy and Planning.

- Saudi Arabian Monetary Agency.

- Capital Market Authority.

- Saudi Organization for Certified Public Accountants.

- Islamic Economics Research Center, King Abdulaziz University.

___________________________________________________________________________________________________

- Islamic University of Malaysia.

- Al-Azhar University.

- Omdurman Islamic University, Sudan.

- Salih Kamil Islamic Economics Research Center, Azhar University.

- The Statistical, Economic and Social Research and Training Centre for Islamic Countries (SESRIC)

- Attar Sokak, No: 4, Gaziosmanpasa, Ankara, 06700 Turkey

- King Faisal Center for Research and Islamic Studies, King Faisal Foundation, Riyadh, Saudi Arabia.

- Loughborough University, Leicestershire, LE11 3TU, United Kingdom

- Al-Maktoum Institute for Arabic and Islamic Studies in Dundee, United Kingdom.

- Institute of Arab and Islamic Studies, Stocker Road, University of Exeter, Exeter, EX4 4ND, UK

- Georgia Islamic Institute of Religious & Social Sciences, P.O. Box 93157, Atlanta, GA. 30377-3157, USA

___________________________________________________________________________________________________

- Private Banks.

- Consulting Houses.

- Media

Proposed Budget

___________________________________________________________________________________________________

The first year’s action plan includes a budget proposal and the requirements of establishing the center, namely, infrastructure and human resources.

- Infrastructure:

the infrastructure falls into two categories, which are:- Physical infrastructure consisting mainly of fixed assets.

- Human infrastructure, which is the most important components of operational costs.

- The physical infrastructure is inclusive of the construction requirements which are the base for determining the cost of fixed assets such as buildings, equipment, labs, hardware and software, vehicles, communication, furniture, references, and modern libraries technologies.

- Added to that is the unforeseen costs, the costs of studies and consultations, development of databases, mail, telephone and computer networks.

- Annual operating costs are inclusive of payroll of personnel (employees, faculty members and researchers) in addition to the costs of miscellaneous consumables, utilities including water, electricity and fuel, as well as other consumables such as paper photocopying and printing, costs of the conference and scientific symposia. Finally, expenses of advertising, promotion, marketing, general and administrative expenses and maintenance expenses.

Following is the structure of a proposed foundation and operating budget of the first three years:

Costs of Establishing Salih Kamil Islamic Banking Study & Research Center

Estimated Budget of the Initial Three Years (SR)

|

Item |

First Year |

Second Year |

Third Year |

Total |

|---|---|---|---|---|

|

Management Payroll |

||||

|

Director of Salih Kamil Center (SR 50,000.00 /month) |

600,000 |

600,000 |

600,000 |

1,800,000 |

|

Managers of Units (5 x 25,000.00/month) |

1,500,000 |

1,500,000 |

1,500,000 |

4,500,000 |

|

Staff (accountant, 3 secretaries, admin. Assistant and a librarian). |

600,000 |

600,000 |

600,000 |

1,800,000 |

|

Public relations and marketing officer |

60,000 |

60,000 |

60,000 |

180,000 |

|

Bonus of supreme committee (7 members x 2 sessions x SR 3,000 /session) |

42,000 |

42,000 |

42,000 |

126,000 |

|

Bonus of Board members (7 members x 4 meetings x 2,000.00 / meeting). |

56,000 |

56,000 |

56,000 |

168,000 |

|

Sub-total |

2,858,000 |

2,858,000 |

2,858,000 |

8,574,000 |

|

Office Furniture & Equipment |

||||

|

Computer networks and peripherals |

75,000 |

10,000 |

10,000 |

95,000 |

|

Laser Printers |

15,000 |

0 |

0 |

15,000 |

|

Photocopy machines |

40,000 |

0 |

0 |

40,000 |

|

Projectors |

15,000 |

0 |

0 |

15,000 |

|

Facsimiles (two) |

5,000 |

0 |

0 |

5,000 |

|

Office Furniture & Equipment and Conference Rooms |

350,000 |

0 |

0 |

350,000 |

|

Center’s website, journals and periodicals subscription and books |

90,000 |

25,000 |

25,000 |

140,000 |

|

Stationery and Computer requirements |

25,000 |

5,000 |

5,000 |

35,000 |

|

Software |

30,000 |

10,000 |

10,000 |

50,000 |

|

Smart boards (3) |

30,000 |

0 |

0 |

30,000 |

|

Sub-total |

675,000 |

50,000 |

50,000 |

775,000 |

|

Other Operating Expenses |

||||

|

Costs of printing, publication and distribution of Center’s magazine, journals and newsletter |

35,000 |

50,000 |

50,000 |

135,000 |

|

Photocopying and binding expenses |

75,000 |

75,000 |

75,000 |

225,000 |

|

Subsidy of specialized studies and researches |

1,000,000 |

1,500,000 |

2,000,000 |

4,500,000 |

|

Host and organize conferences, symposia and seminars, etc. |

300,000 |

400,000 |

500,000 |

1,200,000 |

|

Petty cash |

50,000 |

50,000 |

50,000 |

150,000 |

|

Faculty members and researchers bonus, study and research expenses. |

2,000,000 |

3,000,000 |

4,000,000 |

9,000,000 |

|

Miscellaneous expenses (telephone, mail, etc.) |

50,000 |

75,000 |

75,000 |

200,000 |

|

Stationery |

15,000 |

15,000 |

15,000 |

45,000 |

|

Marketing and Promotion |

50,000 |

50,000 |

50,000 |

150,000 |

|

Property Lease * |

500,000 |

500,000 |

1,500,000 |

2,500,000 |

|

Electricity, water and other utilities * |

100,000 |

100,000 |

200,000 |

400,000 |

|

Sub-total |

4,175,000 |

5,815,000 |

8,515,000 |

18,505,000 |

|

Grand Total |

6,175,000 |

8,815,000 |

12,515,000 |

27,505,000 |

|

Reserve |

110,000 |

110,000 |

110,000 |

330,000 |

|

Grand Total Inclusive of Reserve |

6,285,000 |

8,925,000 |

12,625,000 |

27,835,000 |

To be provided by the University.